Student loan rates drop

Aug 18, 2013

Students borrowing money to pay for school can breathe a little easier after Congress approved lower interest rates for federal student loans taken out after July 1 of this year, but rates on future loans are expected to climb if the economy improves.

The College Cost Reduction and Access Act was passed in 2007 and decreased interest rates on federal subsidized loans to 3.4 percent in 2011. Last year, Congress passed a one-year extension at a reported cost of $6 billion, but on July 1, 2013, rates for subsidized loans jumped to 6.8 percent.

More than a month later, Congress agreed on a bill and President Barack Obama signed it into law Aug. 9. The new legislation attaches student loan interest rates to the 10-year Treasury note, which varies based on the economy.

Though additional loans taken out in the future may have different interest rates, each loan borrowed will have a fixed rate that is carried throughout the life of that loan. New rates will also be retroactively applied to loans taken out between July 1 and Aug. 9, when the rates on subsidized loans were higher.

“As with anything it really depends on how much in loans a student has taken,” said Michelle Rhodes, director of Financial Aid at Grand Valley State University. “With the lowering of the interest rates for this year, it’s an overall good thing for students right now because over the life of the loan it could save a student $1,500 to $2,500.”

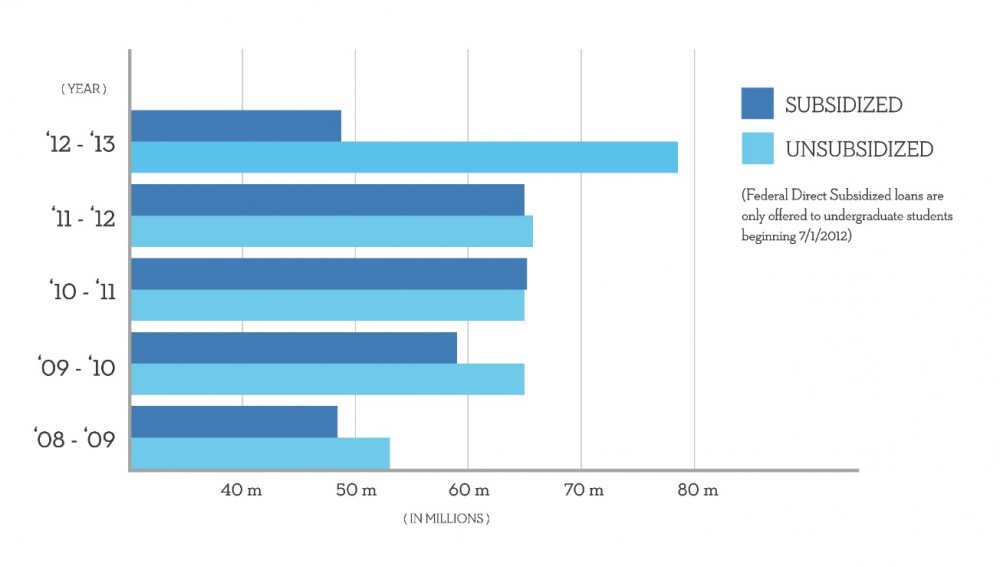

For the 2012-2013 school year, there were about 11,600 GVSU students who borrowed $50 million in subsidized loans and 13,600 students who took out $79 million in unsubsidized loans.

Though the new legislation allows future rates to vary with the economy, it also places a cap on how high those interest rates can be.

Both subsidized and unsubsidized loans are available to undergraduate students at the current interest rate of 3.86 percent—which compares favorably to last year’s rates of 3.4 and 6.8 percent, respectively—and are capped at 8.25 percent for future loans.

Graduate students, who aren’t eligible for subsidized loans, are able to borrow unsubsidized loans at the current rate of 5.41 percent with a cap of 9.5 percent on future loans.

PLUS loans are available to graduate students, professional students and parents of undergraduate students at a 6.41 percent interest rate and are capped at 10.5 percent for future loans.

Though many private loans offer a lower interest rate, they aren’t always the best option.

“Typically with a private loan you need a cosigner and sometimes you can get a better interest rate,” Rhodes said, but the new 3.86 percent rate is still “competitive.”

“Typically the subsidized loan is the best one because interest doesn’t accrue right away,” she said.

Unlike unsubsidized loans, the government pays interest on subsidized loans for as long as the student is enrolled in school.

Rhodes said loans are determined by factors like need, grade level, satisfactory academic progress and an overall eligibility, which involves staying under the maximum limit for each type of loan.

Subsidized loans are limited to $3,500 for the freshmen year of school, $4,500 for the next year, $5,500 after that and a lifetime limit of $23,000.

Dependent undergraduate students, who are still claimed by someone else on tax returns, have a borrowing limit of $31,000 for both subsidized and unsubsidized loans. An independent undergraduate student can borrow up to $57,500.

Perkins loans, which are awarded primarily by the university to students who demonstrate need, have an interest rate of 5 percent and a maximum borrowing limit of $20,000 for undergraduates and $40,000 for graduate students.

Consolidation loans allow borrowers to bundle up other federal loans into one payment. Interest rates differ as they depend on averaging the rates of the loans being consolidated, but are capped at 8.25 percent.

Rhodes said people usually wait until they are finished borrowing money to consolidate loans, though it may not always be wise to consolidate loans that have lower interest rates with loans that have higher rates.

“The best advice is for students to really think about what they need to borrow each year,” said Jenna Poll, associate director of Financial Aid at GVSU.

Poll said GVSU students are generally better equipped than others across the nation to pay back loans. According to the university’s 2012-2013 Accountability Report, GVSU had a loan default rate of 2.7 compared to the state average of 4.6.

“We always encourage students to be smart borrowers and smart consumers,” Poll said. “We hope students are doing their homework and paying attention to the interest rates and only borrowing what they need to pay the bill.”